And the interloper

And the interloper

Some more recent movies to stream….or not.

This is a movie where evil triumphs over good, where man loses out to machine. And yet a lot of it is pretty darn funny.

Man-su is a man who has everything, a charming wife, a daughter and a son. He has purchased and renovated his boyhood home. He’s passionate about plants and has a thriving greenhouse. He’s a line manager at Solar Paper and was even once named “Pulp Man of the Year.”

But an American company has bought out Solar and as they move to cut expenses Man-su, who has been with the company for 25 years, has 25 minutes to get out. The serious, social commentary part of this movie is a look at the devastation this has on the family. He may lose his house, he can’t pay for his daughter’s cello lessons, he even has to give up his two dogs because “there’s too many mouths to feed.” His daughter won’t talk and his son resorts to shoplifting.

Man-su isn’t the only paper man out of work because of changes in the economy in Korea. In fact, there’s another Pulp Man of the Year on the job market. There’s one paper company doing well and hiring. How to get a job there? A great resume? Better interviewing skills? References? Nope. He has no other choice. Eliminate the competition. Literally.

This movie has everything: murder, family devotion, corporate greed, marital strife and a healthy dose of satire. It’s long enough to include all that and more. A masterpiece…of sorts.

(Available to rent at Prime Video or Fandango at Home

A university researcher is pursued by a hit man hired by an unscrupulous corporate executive. That is the glue that holds together the plot, but there is oh so much more going on in this movie. There’s corrupt cops, corrupt government officials, bullying businessmen. There’s hired killers subcontracting to other hired killers. There’s a lovely refuge for the potential victims of all these predators run by a charming old woman. And last, but not least, there’s the mysterious story of the severed human leg discovered inside the body of a dead shark. Local media can’t get enough of that one and it finds its way into the dreams of young and old.

It’s Brazil in the 1970’s. Was the country really this dangerous and chaotic? It may well have been since it was in the throes of a military dictatorship. The movie takes place during Carnival time and the papers are keeping tabs on the fatality count. It hits 100.

The director of this movie, Kleber Mendonca Filho, won the best director award this year at Cannes. Easy to see why. One technique that he uses is to not spell everything out, leaving some questions unanswered. That may not always work but it does here. The loose ends of the story add a layer of mystery to the adventure. Wagner Moura, who played the lead role, was named best actor at Cannes.

This is by far the best fictional movie I saw at the festival. It’s nearly three hours, but it’s so engaging that the time flies by. It is Brazil’s entry in the Academy Awards for Best Foreign Film.

The Secret Agent is scheduled to be released in theaters Dec. 5.

(Available to rent on Prime Video, Apple TV or Fandango at Home)

A massive exercise in grief. You’ll feel it right down to your toes. And it will stick after the movie is done and gone.

This is a story of William Shakespeare and his family. It is based on a book I didn’t read;a history I know little about. What I do know is Shakespeare is known for his tragedies and the movie Hamnet easily fits that description.

The story includes Shakespeare, his parents, his wife (the daughter of a ‘forest witch), and his three children, one of which is Hamnet. We are advised at the start of the movie that the names Hamlet and Hamnet are one and the same.

Shakespeare spends his time in London working on writing and staging his plays. Agnes, his wife, stays behind in Stratford with the children. Turns out that that kind of arrangement didn’t work out so well in the 16th century either. Add to the mix the plague.

The highlight of the movie is Jesse Buckley’s portrayal of Agnes. Some movies are referred to as ‘feel good’ films. The opposite term isn’t used but Hamnet deserves the ‘feel bad’ title.

(Available to rent on Prime Video or Fandango at Home)

A brash, loud, in-your-face movie. If you feel you need to add more arrogant narcissists to your life, welcome in Marty Mauser, aka Marty Supreme. Supreme he is not.

On one level this is a movie about table tennis. But along the way it hits on illicit affairs, dognappers, gangsters and hucksters. This is not your classical dedicated athlete story about the guy who sacrifices and works his butt off to achieve his dreams. Marty is a liar, thief, and con artist who disrespects everyone in his path.

There are some cringeworthy moments, like the scene from a concentration camp that pops up out of the blue and the foul ‘joke’ about Auschitz. I also thought the stereotypes in the portrayal of Japanese people watching a table tennis tournament were offensive.

There is an element of historical fiction. Indeed, the strength of the movie is in creating a 50’s style rough-and-tumble streetwise New Yorky vibe. It’s fast-moving, slickly produced and has big stars. (I don’t think assuming the persona of Marty Mauser would have been a stretch for Timothy Chalamet.) There’s a tear-jerker sentimental ending but it’s otherwise hard to sympathize with any of these characters.

(Available to rent on Prime Video or Fandango at Home)

Two hours or so of a supposedly high society party in a mansion. And these are academics, so it’s surely not contemporary. But because of that, a lost manuscript is a key part of the plot, that is, amidst the drunkenness, infidelity, lewdness and other forms of misbehavior that characterizes this shindig. Hedda Gabler, the evil mistress hostess, is the ringleader for most of it.

I have neither read nor seen the Henrik Ibsen play that the movie is based on so I can’t offer any comparisons. But I would think it’s a safe bet that the interracial and Lesbian trysts were probably not part of Ibsen’s 19th century work. The movie does borrow liberally from other classic pieces of literature, most notably the Great Gatsby from which both the party scene and the time frame seem to have been derived. It brings to mind a number of other books and movies about women trapped in marriages they don’t really want.

This is a story of a group of equally unlikeable people each self-destructing in their own way. As a genre, I have to say that total despair is not my favorite. That is not to say the acting isn’t excellent, the cinematography well done and the script cleverly put together.

Hedda is available on Prime Video.

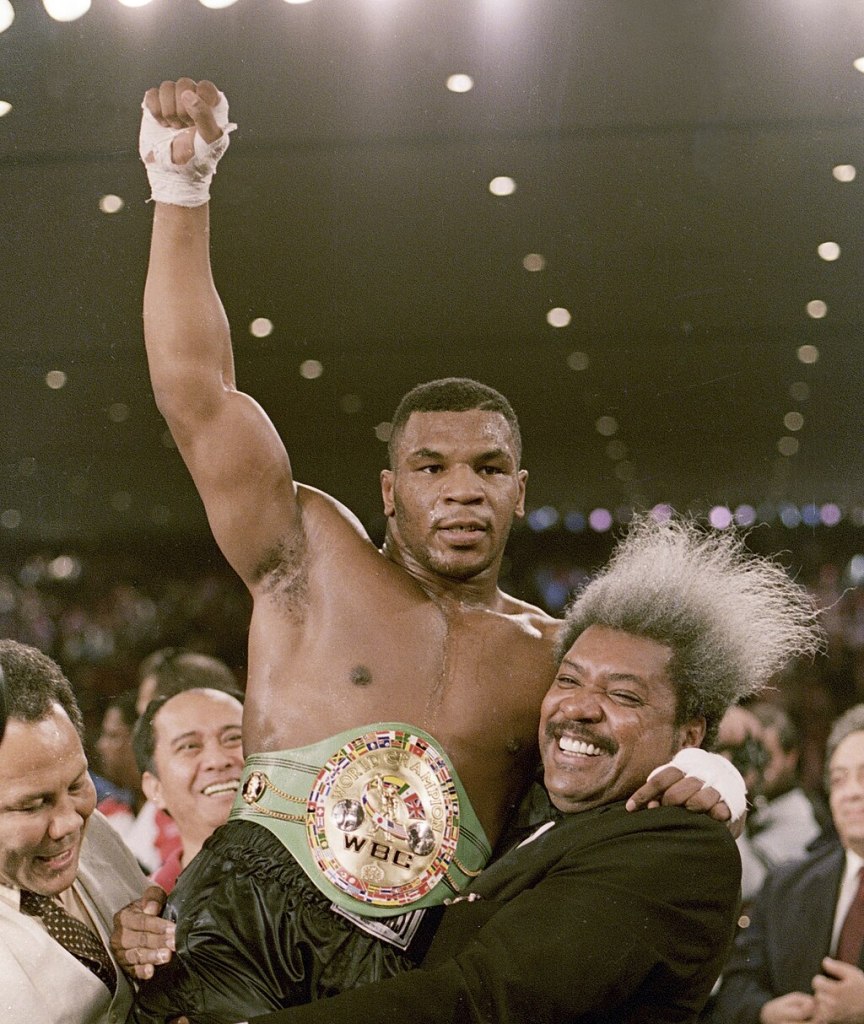

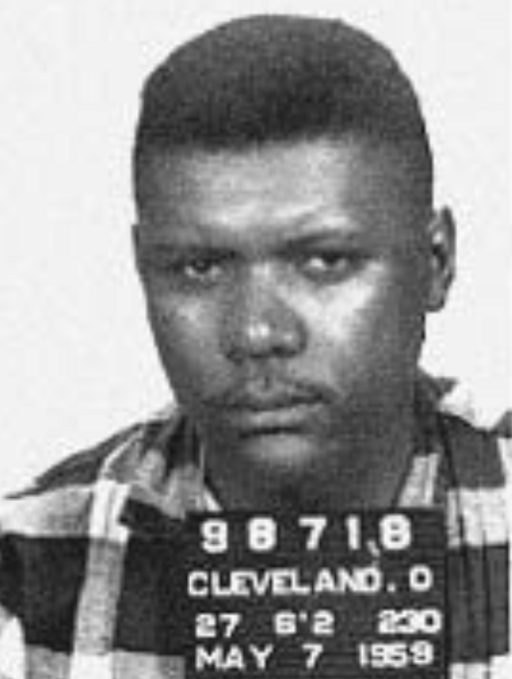

You may remember Don King for his seemingly electrified Afro, for his vociferous gift of gab, or for his lifelong devotion to braggadocio. Or, you may remember him for the famous boxing matches he was responsible for promoting: the “Rumble in the Jungle” with George Foreman and Muhammad Ali, and the “Thrilla in Manila” with Ali and Joe Frazier.

With his contractual relationships with the top boxers of the era, King all but ruled the sport in the 1970’s and 80’s. “King’s impact on American life extended far beyond boxing. He was Black and from the streets. Rather than hide his background, he forced America to accept him as he was. He was the first Black man to dominate a major industry in the United States. We’re not talking about an athlete, singer or movie star who made his mark by entertaining people. We’re talking about commerce and economic control.

“King was larger than boxing. Over the years, he met with Nelson Mandela, Mikhail Gorbachev, Vladimir Putin, Leonid Brezhnev, two Popes (John Paul II and Benedict XVI), Tony Blair, Fidel Castro, Ferdinand Marcos and eight US Presidents.”(Thomas Hauser, The Guardian, June 14, 2023)

He also met with an unending stream of lawyers, prosecutors and judges. Seems as though just about every boxer he ever represented ended up suing him. Mike Tyson was quoted on ESPN Classic as saying “He did more bad to black fighters than any white promoter ever in the history of boxing.”

“In 1998, Tyson sued King for $100 million, claiming that King had been skimming money from the fighter for years. Tyson also alleged that King made him sign contracts while he was in jail, never giving him the opportunity to seek a lawyer’s advice on the matter.” (Amber Petty, grunge.com, Oct. 6, 2021)

“Former heavyweight champion Tim Witherspoon was involved in bitter litigation with King, ending in an out-of-court settlement. Witherspoon was promised $550,000 for his 1986 title bout with Frank Bruno but ended up with a little over $90,000. King contended that he had funnelled numerous purse advances to Witherspoon and that, in fact, the fighter got everything that was due to him. (Boxing News Online, Oct. 4, 2024)

The AP carried this story (May 9, 2003):

“Attorneys for (Lennox) Lewis filed suit in a New York court Thursday seeking up to $385 million for what they said was a plot by King to snatch Tyson away from his current promoters and get the former champion to fight for him again. The suit claims King cost Lewis $10 million by keeping Tyson off of a June 21 fight card in Los Angeles and another $25 million by stopping him from signing a deal for an eventual rematch between the two fighters. The suit alleges that King threatened the life of Tyson’s friend and adviser, Los Angeles agent Jeff Wald, and conspired with a female friend of Tyson’s to keep him sequestered in a New York hotel last month, preventing him from signing the Lewis contract.”

Another AP story (Dec. 14, 2003 by Jim Litke) had the detail of a suit against King by former middleweight champion Terry Norris. Norris, “who suffered brain damage from all the punches absorbed over the course of his career, was broke at the end of it – despite fighting for millions in purses.” King settled that one for $7.5 million.

“In 1984, King was indicted on 23 counts of federal tax evasion in connection with alleged skimming of more than $1 million from Don King Productions. He was cleared of all charges, though one of his vice-presidents went to prison, by a jury that had, by the end, fallen in love with him. ‘I don’t think I realized it until after, when the jurors went up and asked him for his autograph,’ says Roanne L. Mann, the federal prosecutor for the case.” (Miami Herald, Oct. 22, 1993)

King was quoted by the Philadelphia Inquirer (Bill Lyon, Oct. 15, 1995) as boasting “They’ve all tried to bring me down. The IRS, the KGB, the FBI, Interpol … and ain’t none of them laid a glove on me yet. I tell you, Don King is God’s child.”

King got in on the legal action himself when he sued ESPN in 2005. “King filed a $2.5 million defamation suit against ESPN for the sports network’s portrayal of him in the SportsCentury series. The profile, which aired in May 2004, referred to King as a ‘snake-oil salesman’ and ‘shameless huckster.’ King disputes the claims he shortchanged Ali and Larry Holmes and funds owed to a hospital from a charity event. ESPN also claims he threatened to kill two people.” (Jeff Hawkins, Northwest Herald, Woodstock, Ill., April 15, 2005) That suit was summarily dismissed by a Florida court.

A different side of King emerges around Christmastime when for several years he has organized turkey giveaways for needy folks in South Florida, where he lives. And, despite his disreputable business practices, he has received his share of accolades for his influence on boxing. In 2013 he was inducted into the Nevada Boxing Hall of Fame. Just last year he was inducted into the International Women’s Boxing Hall of Fame. This a result of his promoting Christy Martin, perhaps the most notable of female boxers.

In 2006, Atlantic City named a street after him. This despite the fact that he was barred by the State of New Jersey from promoting in the casinos there. Apparently he had given away some turkeys in AC as well. In Cleveland, where King was born, the city council considered naming a street after him as well. But the controversy that consideration created killed the plan. Turns out that very street is where King stomped an employee to death in 1966. (He was convicted of manslaughter and served four years in prison before being pardoned by Ohio Governor James Rhodes.)

It should not come as a surprise that King has had a long relationship with Donald Trump. Matt Flegenheimer of the New York Times wrote (June 18, 2024): “For more than three decades, the boxing promoter Don King and Donald J. Trump have shared an enduring friendship and some defining surface similarities: an unmissable hairdo and a self-regarding gumption that became a kind of superpower, a trail of beleaguered creditors and an unswerving conviction that more is more.”

During the 2016 Presidential campaign the editorial writers at the Newark (N.J.) Star Ledger (Sept. 24, 2016) expounded on the comparison:

“So Donald Trump embraced King on Wednesday, presenting him as a paragon of the African-American virtue, even though King is reviled by almost everyone in the black community who ever had the misfortune of doing business with him. King was chosen to introduce Trump at a minority outreach event, and after wandering into a thicket of incoherent blather for a few minutes, he dropped the N-word while making a tortuous point about the inequities faced by blacks, and how they should better ‘assimilate’ rather than ‘alienate.’ If Trump brought King aboard to expand his insight into the black community, he’s going to be disappointed because King’s primary expertise is in corruption, greed and blind hairdressers. If that sounds like something Trump would say, it’s not an accident, because Trump and King are kindred spirits ‘the ebony and ivory of con men,’ as one blogger put it.

They share a need for self-promotion, a lovable rogue appeal that is charismatic to some but repellent to most, an unapologetic love of money and a compulsion for screwing their business partners.”

King is now 94. He still lives in South Florida. His wife of 50 years, Henrietta, died in 2010. There are two constants to the Don King story: boxing promotion and lawsuits.

Just last year, news of a $3 billion legal action appeared in Fortune. (Amanda Getut, Jan. 5, 2025)

“Controversial boxing promoter Don King and his Florida-based production company are being sued by BYD Sports and CEO Cecil Miller in a civil challenge alleging fraud, defamation, breach of contract, and other allegations, according to a complaint filed in the U.S. District Court for the Southern District of New York. Plaintiffs are seeking damages of $3 billion.

According to the complaint and court documents detailing their interactions, King allegedly encouraged Miller to pursue a 50th anniversary matchup called Rumble in the Jungle 2 in Africa, which Miller did despite the lack of a formal agreement in place. After setting in motion the groundwork for a star-studded series of boxing matches in Nigeria—replete with a wish list for musical events with artists such as John Legend, Alicia Keys, and Wyclef Jean—King allegedly bailed when Miller asked him to help promote the event and disavowed Miller before the events could be finalized.”

Two months later Sports Illustrated (Lewis Watson, March 11, 2025) reported on a foreclosure action involving King’s headquarters. “93-year-old boxing promoter Don King has been named in a $5.35 million foreclosure lawsuit over his headquarters complex that ‘Don King Productions’ operates out of Deerfield Beach, Florida, USA.

“There have been missing payments since August 2024 meaning the borrower (King) went into default and now owes $5.35 million plus interest accrued, as well as fees.”

King skirted that one by selling the property a few months later for more than what was owed.

As for promoting boxing, King is still at it, though neither the fighters nor the matches bear any resemblance to those during his heyday. The current state of affairs was described by Thomas Hauser of The Guardian (June 14, 2023) after a press conference promoting a Miami fight involving a past-his-prime King client.

“King was wearing black slacks and a conservative gray sport jacket festooned with ribbons and pins. His famed ‘Only in America’ jacket was nowhere in sight. There was a time when King had a nobility about him. Watching him at the May press conference was sad. He looked old (which he is) and rambled (which was not uncommon during his years in the spotlight). But King’s monologues are less entertaining now than they were in the past. This one was a disjointed sermon about Donald Trump, Joe Biden, Putin and Ukraine.”

-0-

(Newspaper and wire service stories that do not include links were accessed on newspapers.com)

See also Whatever Happened To?

Paterson, N.J., Feb. 2, 2026

Some recent movies to stream….or not.

It starts like a game of Clue. First there’s the scene of the crime. Then there’s the murder weapon. Then everything goes haywire. Eventually we question the murder itself — before or after the dead man wakes.

The story starts with a well-meaning young priest: a former boxer who once killed a man in the ring. He is assigned to be the number two at a small church in New York State. The number one is a manipulative, insulting spiritual dictator who has reduced his congregation to a small group of suspect characters. And suspects are what they will become.

Benoit Blanc (played by Daniel Craig) is the Hercule Poirot of this mystery which will recall Agatha Christie. Is he on the verge of a brilliant reveal? Or has he lost the plot? True to form for the genre, it is the most innocent looking who you suspect of being guilty and vice versa.

This third of the Knives Out mysteries boosts a strong cast. And it works in a touch of humor and social commentary while pushing you toward the edge of your seat.

(Available on Netflix)\

If the lead character Linda had legs she’d kick: her husband, her daughter’s doctor, her therapist, her patients (yes, she’s a therapist too), her landlord who won’t fix the giant hole in her ceiling, the clerk in the motel where she’s staying waiting for repairs, the parking garage attendant and the fellow motel resident who tries to be nice and help her get drugs (yes, that’s ASAP Rocky).

Linda does in fact have legs. What she doesn’t have is the wherewithal to deal with all of the aforementioned life pressures. So she rants, shouts, fights with everybody, hides and drinks.

Watching this woman spiral downward as a parent, wife, and therapist may not sound like good entertainment but this movie is so much better than my description would lead you to believe. There’s some interesting techniques used by the director like not showing the face of the ill child and dreams of scenarios that are even worse. The movie generates a constant tension. Will Linda do something yet more self-destructive or will she rally?

We’ve all had bad days when parenting, housing and job-related problems seemed overwhelming. You won’t learn how to handle that by watching this movie but it might give you a boost to know you didn’t kick anybody.

(Rent or purchase from Prime Video or Apple TV)

A young army psychologist is sent to Nuremberg to treat the Nazi officials who are about to stand trial. His assignment: keep them from killing themselves before they’re tried and likely executed.

The movie explores the relationship between the psychologist, Douglas Kelley, and Herman Goring, Hitler’s second in command and the highest ranking Nazi at Nuremberg. Like any psychologist, I suppose, Kelley works to earn the trust of his prisoner/patient. He does. He befriends him. He runs letters back and forth to Goring’s wife and daughter. And he betrays him. There are times when I felt the movie was humanizing Goring which was uncomfortable.

Speaking of which, parts of this film are hard to watch. There are horrific scenes, shown at the Nuremberg trial, of what the allies found when they entered the concentration camps. And there’s some gut-wrenching stories told.

The movie is based on the book “The Nazi and the Psychologist.” I felt some things could be a stretch. Was Kelley really a key factor in Goring’s conviction? Was the American prosecutor Robert Jackson really such a bumbler? And what about the part where Kelley spills the beans about Goring to a very attractive journalist he meets in a bar?

The movie is heavy and emotional. It’s full of history that there is no doubt about. And it raises important questions. One is the limits of confidentiality in a doctor/patient relationship. And more importantly the issue of how something like this could happen. You can’t consider that and not think of some of the stuff happening now.

(Rent or purchase from Prime Video or Apple TV)

A dreary affair, dripping with family angst. The family is Gustav Borg and his two daughters. Borg is a filmmaker of note who has been inactive for the last decade. Nora, the older daughter, is an actor with stage fright who nonetheless seems to get leading roles on local theater productions. Her sister Agnes is the voice of reason in this group with a husband and daughter of her own.

Oh, one more thing about this family. Borg apparently flew the coop and disappeared while the girls were growing up. So when he shows up after their mother’s death with a plan to produce one more movie, a movie about Nora that he wants her to star in, he is not what you’d call welcomed with open arms. Instead, a lifetime’s worth of anger and resentment surfaces.

Behind a tale of relationship trial and error, the stories of three generations of this family are told. It is a story that includes persecution, torture and suicide.

There is some sentimental value mixed in with all the anxiety. But it’s a slow churn. The pacing reminds me of Ingmar Bergman. (Nothing else does.) Don’t get too comfortable on the couch if you want to make it to the end of this one.

(Rent or purchase from Prime Video or AppleTV)

In between the days of Chuck Berry and the era of The Rolling Stones, there was Mitch Ryder and the Detroit Wheels. Turn on rock radio in the mid-60’s, whether the popular AM stations or the new FM alternatives and you’d hear “Devil with a Blue Dress On” or “Jenny Take a Ride” or “Sock it to Me, Baby.” One writer (Scott Benares of the Fort Lauderdale News, Sept.. 23, 1983) described a band “fronted by a nervous, brassy kid named Bill Levise Jr. who had an aggressive, gravelly voice that leaped off vinyl and nearly mugged listeners.”

William Levise Jr., was Mitch Ryder’s real name. Born in 1945 in a Detroit suburb, the story is that he found his performance name in a Manhattan phone book.

By 1968, poof! Mitch Ryder and the Detroit Wheels were no more. Things spiraled downward from there. William Schmidt of the Detroit Free Press (March 5, 1972) offered this summary: “It’s difficult to say just where things went wrong. Maybe in late 1966, when he broke up with the Detroit Wheels and was set on a new and disastrous course by his manager. Or maybe in 1968, when he was billed briefly as a cabaret star and his agents released this bomb recording, Mitch Ryder’s funkless rendition of ‘What Now, My Love?’ But by 1970, there wasn’t much left. That’s the year Mitch’s wife sued him for divorce, and the judge gave her custody of Mitch’s little boy and girl. And then, in 1971, there was the bankruptcy, $176,000 unpaid bills. About $15,000 in unpaid income tax. Another $24,000 owed to a booking agency. $9,000 to the musician’s union. And dozens of little bills – $5 here, $30 there, $12 someplace else – all of it owed to motels and restaurants and gas stations that Mitch Ryder had passed through during the last two years, moving around and running out of luck. Playing out his time and losing all his money.”

Ryder would later tell Robert Palmer of the New York Times (June 29, 1983): ”The people who were running my career thought I should go to Vegas and become the new Tom Jones. And I couldn’t handle it; the schmaltz just wasn’t me. Unfortunately, I’d been real young when I signed with (producer Bob) Crew, and essentially I said, ‘I don’t care what you do to me, just make me feel good.’ I did, for a while. But in the end, people made millions off of me and I didn’t come out with much of anything. Ever since, I’ve been kind of gun shy.”

For a while, he left music behind. “Unhappy with the route his management was forcing him to go musically, Ryder chose to walk away from the industry from 1973-77. ‘I did menial labor – worked around dangerous chemicals,’ is all the always outspoken, but fiercely private Ryder would say. ‘I had to. … I did what I had to do.’” (Federico Martinez, Muskegon Journal, July 16, 2009)

For the next five decades, he has been on the comeback trail. A trail with its ups and downs. He got a boost in 1983 when he connected with John Couger Mellencamp. The latter produced a Mitch Ryder album titled “Never Kick a Sleeping Dog.” While nowhere near the success of the Detroit Wheels era, it was well received. But another setback would follow.

“…serious problems with alcohol and drugs took their toll. A negative review of one of his shows in a Calgary newspaper helped convince Ryder it was time to enter a rehabilitation program. ‘There was a Calgary headline that said, ‘Ryder Bottoms Out’,’ explained William Levise Jr. ‘And I guess I agreed with him.’

“‘Two years ago I entered the hospital, and I’ve been clean ever since – not a drop. The importance for me is just being out there. I need to work.’” (Nick Krewen, Hamilton Spectator, Jan. 25, 1990)

One year after that was written, Ryder is back on the road and Jeff Spevak of the Rochester Democrat and Chronicle (Dec. 23, 1991) had this review of one of his shows: “The band filters onto the stage in darkness, watched by the glowing red bat eyes of the amps and a comfortably full house at the Horizontal Boogie Bar. These people want to see a genuine rock ‘n’ roll legend of the ’60s.

“But which one of these coffee-house beatniks is Mitch Ryder? The Wheels, serious-looking musicians – bang on their instruments to make sure they’re plugged in as roadies with handcuffs on their belts (what kind of trouble are they expecting?) do some last-minute tinkering. Then one of the men in black speaks – he’s opening the show by introducing the members of the band. So, that’s Mitch Ryder. He’s wearing dark glasses, his hair swept back over his head. The rock ‘n’ roll legend looks like Jack Nicholson. Ryder shifts through the fragments of the ’60s like a man kicking around the pile of rubble that was once his house before the tornado came through town.”

Ryder has been a nostalgia act going on 50 some years now. But not in Europe.

“‘I literally have two parallel careers,’ Ryder said via phone recently. ‘My European career started in 1978, and I record fresh material almost every year. The European stuff keeps my creativity elevated.

‘I love giving the people what they want, but I get more gratification performing the new stuff. In this country, people aren’t interested in the art; all they’re interested in is a time period.’ (Timothy Flynn, Flint Journal, Aug. 6, 2009)

One other issue hampered Ryder in the U.S.

“’I have a contemporary life. I play gigs with people that are currently happening over there. It’s better for me in Europe than it is in the U.S.’ In fact, Ryder reports that he regularly releases albums in Europe. ‘My last album was called Rite of Passage, and was cut with East German jazz musicians,’ he says. ‘It’s one of the best albums I’ve ever done.’

“Ryder says Rite of Passage will never see the light of day in North America for controversial reasons- – namely a song supporting an infamous U.S. doctor renowned for physician assisted suicides. ‘I’ve had to suppress it here because I wrote a song to Dr. Jack Kevorkian, who’s a personal friend,’ explains Ryder.

“’It got a lot of negative press here, especially around Detroit last summer. They prohibited me from doing the song at a state fair, so I refused to play the fair. That’s what I like about doing music over in Europe. You can do things without fear of consequences or reprisal.’” (Nick Krewen, Waterloo Region Record, April 11, 1995)

In 2012, Ryder released an autobiography titled “Devils & Blue Dresses: My Wild Ride as a Rock and Roll Legend,” a title he professed to hate. Brian McCollum of the Detroit Free Press offered this summary (Jan. 12, 2012): “It’s an exhaustive — and sometimes emotionally exhausting — account of his tumultuous life and career, a trip that began with ’60s hits such as Jenny Take a Ride! and Devil with a Blue Dress. For Ryder, the book was a tough but cathartic journey that found him revisiting his early whirl of fame, the start of a personal roller coaster that included showbiz foul play, busted marriages, periods of drug abuse and squalor, betrayals both dished out and received. Salted with dark humor, peppered with political and cultural asides, the book includes glimpses at local rock personalities — from Bob Seger to Creem magazine staffers — and Ryder’s celebrity anecdotes, including partying with the Beatles and watching Bob Dylan record Highway 61 Revisited.”

Now 80, Ryder is still making music and playing gigs. In 2024 he released a double live album on a German label called “The Roof is on Fire.” Last year saw a new studio album called “With Love” that he recorded in Detroit. In August he was the headliner at the Waukesha (Mich.) Rotary Blues Fest.

Then, in November, he showed up for a gig that was booked more than 50 years ago.

“The year was 1968. Rock and roll group Mitch Ryder and the Detroit Wheels were scoring hit after hit across America, with singles like “

‘Sock It To Me’ and ‘Devil With A Blue Dress On’ dominating radio airwaves.

“So it’s easy to understand why students at Wooster (Ohio) High School were ecstatic to learn that Mitch Ryder himself was coming to town to perform a concert — just for them.

“Until he didn’t.

“At the last minute, for reasons still unknown, Mitch Ryder finked out.

“Our student newspaper had the headline ‘Mitch Ryder Finks Out Quick,’” recalled Carolyn Robinson, Wooster Class of 1971.

“The concert had been a prize from a WKYC radio contest, challenging area schools to raise money for the American Heart Association.

“Then, nearly six decades later, Robinson found herself fundraising to restore Wooster’s historic Lyric Theater. That’s when inspiration struck.

“‘I thought, I’ll reach out to Mitch Ryder and see if he’ll come to Wooster to fulfill his promise from 57 years ago,’ she said.

“To her surprise, he said yes.

“This week, the now 80-year-old musician, still touring globally and riding high on a Billboard top-five album, returned to Wooster to make amends.

“His first stop was a meet-and-greet at the Lyric Theater, followed by a visit to the Wayne County Historical Society. Then, at long last, he headed to Wooster High School — the scene of the long-ago cancellation — to finally deliver the performance that never was.

“‘I’m here now to bring joy and happiness to everybody,’ Ryder said. ‘Most of the people out there are my age — we’ll have to check their pulses every once in a while!’ (Author: Mike Polk Jr. and Zachariah Durr, WKYC [Cleveland], Nov. 7, 2025).

-0-

(Newspaper stories cited above were accessed on newspapers.com.)

See also, Whatever Happened To?

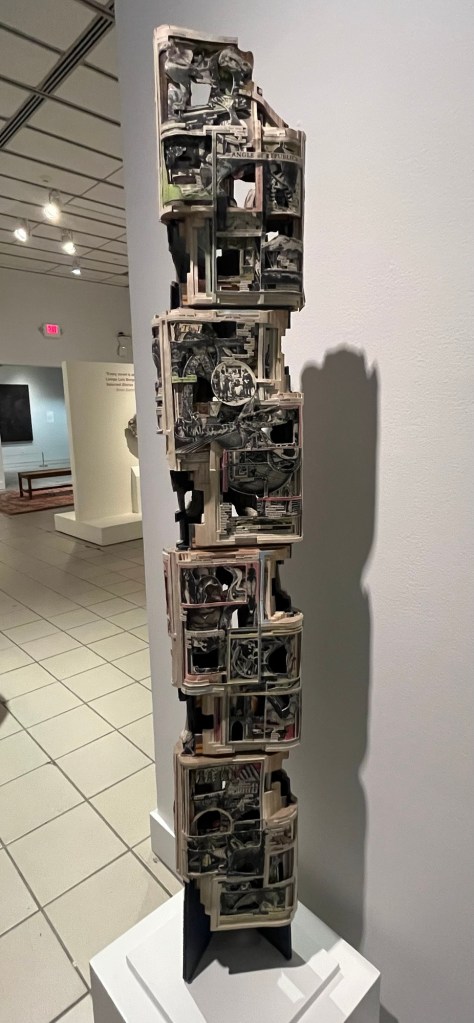

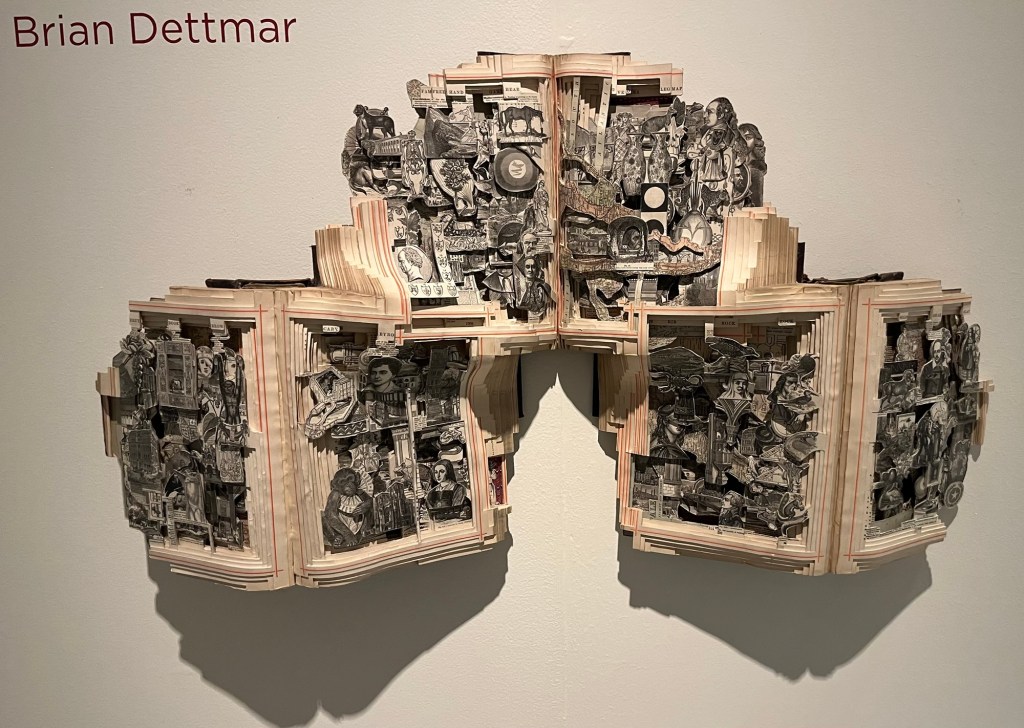

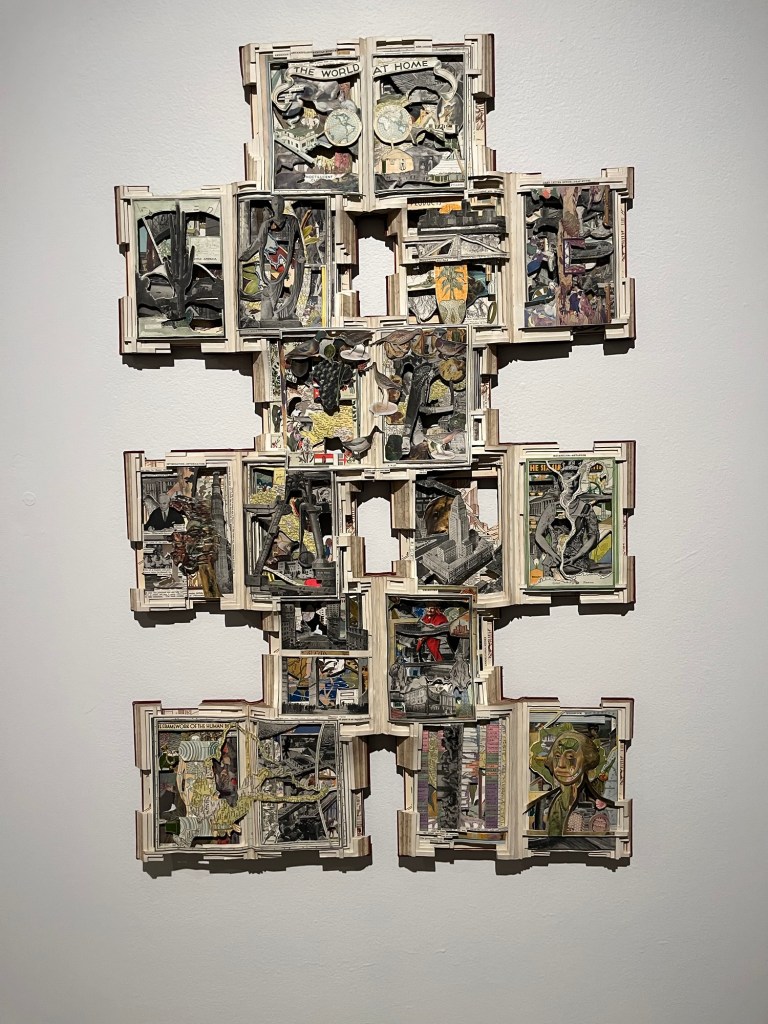

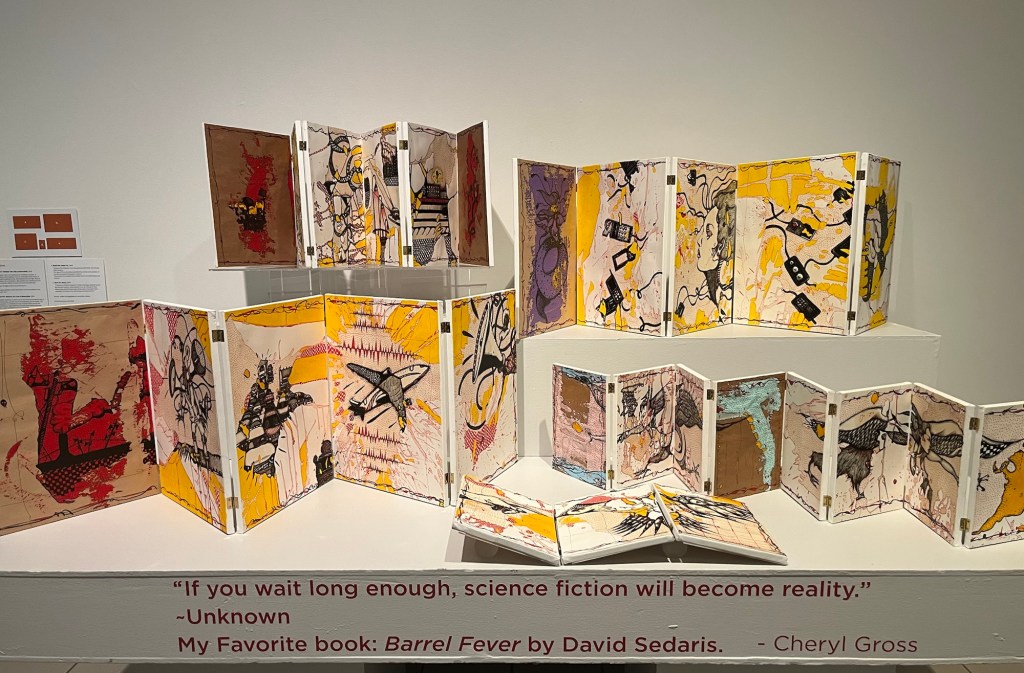

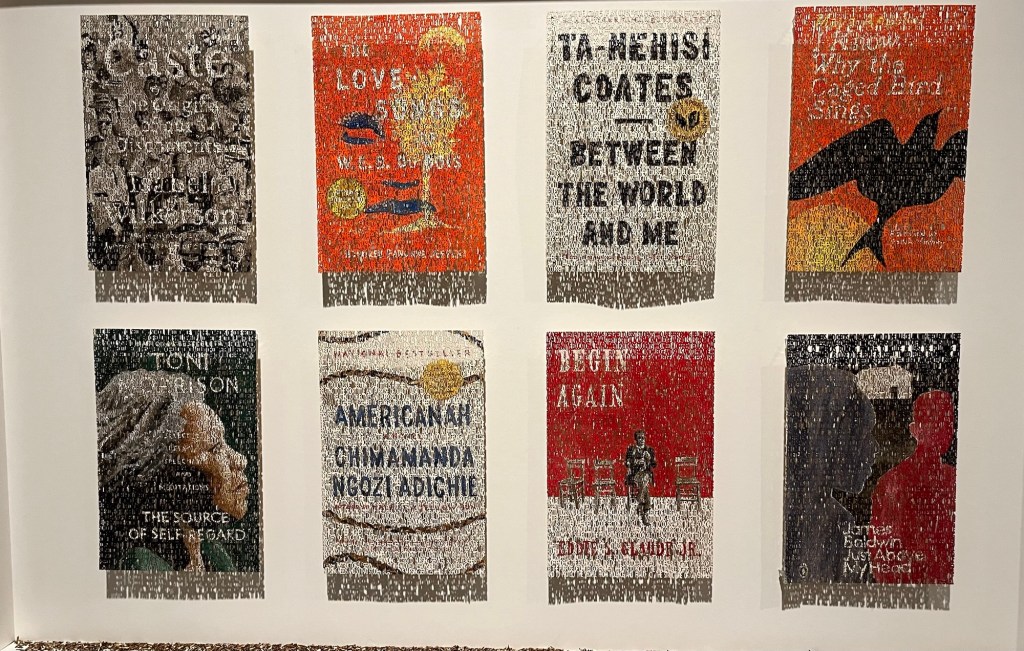

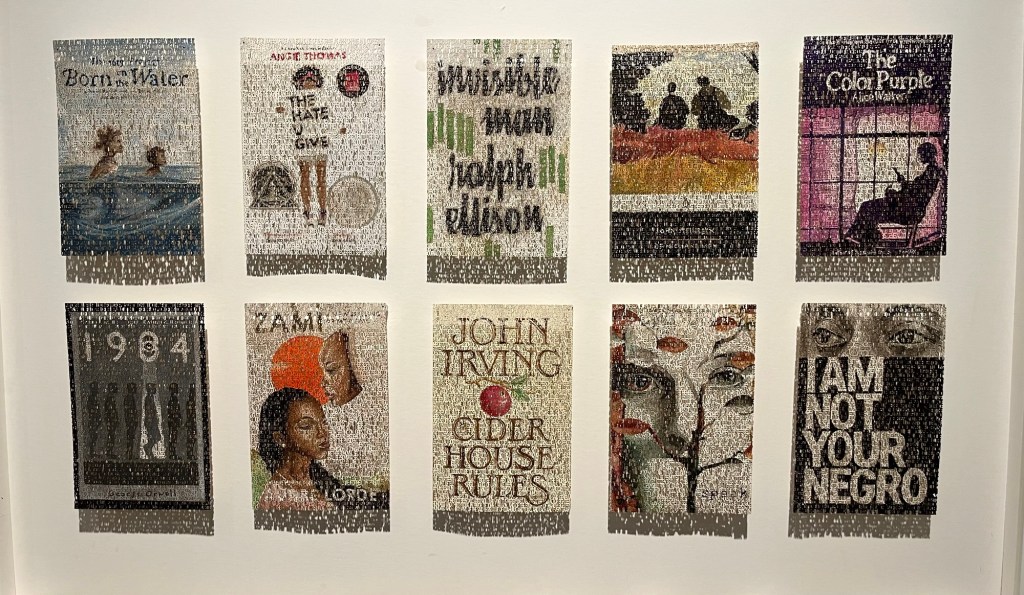

The Morris Museum, Morristown Museum

The pieces in this exhibit are not just about books, many are made out of books. In the words of the curators, “the book is reimagined not only as an object of content, but as a site of transformation—where material, meaning, and message converge.”

Some recent films added to popular streaming services. Some worth a watch. Some not so much.

Bugonia ⭐️⭐️⭐️⭐️⭐️

Ever encounter a CEO who you suspected of being an alien. That’s what Teddy Gatz (played by Jesse Plemons) thinks of pharmaceutical CEO Michele Fuller (played by Emma Stone). Fuller’s company had provided Gatz’ mom with a treatment that put her in a coma. Couldn’t help but think of Luigi Mangione. Or the guy who stormed the Washington PizzaGate restaurant.

This is a dystopian tale of the human race self destructing. Nobody’s calling climate change a hoax in Bugonia.

Of the people I know who saw this movie, it got mixed reviews. Not from me. I enjoyed it. It’s engaging, keeps you guessing and is funny but with an underlying depth. Stone is great. So is Plemons (though I kept thinking he looked like Clayton Kershaw). I don’t think it’s a spoiler to note the movie ends with the song “Where Have All the Flowers Gone.” A fitting conclusion.

(Available on Peacock and Amazon Prime)

It Was Just an Accident ⭐️⭐️⭐️⭐️⭐️

First comes the accident. A man driving home with his wife and daughter hits a dog on a dark road. His car fails. A Good Samaritan fixes it but his co-worker identifies the driver as Peg Leg, a member of an authoritarian regime that violently repressed striking workers.

The co-worker, Vahid, seizes the man, locks him in a trunk in his van and prepares to bury him alive. But he has some doubt. So he tracks down others of the formerly imprisoned in quest of a clear identification. Along the way there are scenes that seem more fitting for a madcap comedy rather than a political thriller, like watching a bride and groom who were posing for photos pushing the van down a highway after it broke down.

But also along the way there are stories of the imprisonment, torture and rape that they experienced. Sometimes they remind each other to show “we’re better than they were.”

The movie captures the pain of a nation. But also its humanity. A brilliant movie.

(Can be purchased or rented on YouTube and Apple)

The Left Handed Girl ⭐️⭐️⭐️⭐️⭐️

Shu-Fen is a single mother living in a shabby apartment in Taipei and trying to support her family as a street vendor. One daughter is a surly, mad-at-the-world sort of teenager. The other is a delightful, left-handed, five or six year old.

This family has a lot to overcome: financial hardship, abuse and unwanted pregnancy, not to mention an unsupportive family. Before it’s over we find out why that teenager is mad at the world. And yet, despite everything, their humanity shines through to the point you could almost call this a feel-good movie.

Much of the film takes place at a night market in Taipei amidst a bevy of stalls. It feels like an accurate portrayal of that environment and of the community it engenders. The cast is pretty magnificent. Sometimes it feels you can learn more of the story reading their faces rather than the subtitles.

(Available on Netflix)

Nouvelle Vague ⭐️⭐️⭐️⭐️

A movie for cinephiles, and especially French ones. If you know of and appreciate the likes of Truffaut, Chabrol and Rossellini, you’ll likely enjoy it. If not, maybe not so much.

Nouvelle Vague is the story of how Jean Luc Goddard made his classic work “Breathless.” The aforementioned directors, and several others, are characters in the movie. They are collaborators, mentors and detractors. Godard is portrayed as something of a mad genius who defies all conventional norms. With little money, time or seemingly much planning or forethought, he produced his masterpiece.

This is a work of cinematic historical fiction. It is the era of the New Wave in France (that’s what Nouvelle Vague means in French). The highlight for me was the performances of Zoey Deutch and Aubrey Dullin, cast as Breathless co-stars Jean Seburg and Jean Paul Belmondo, respectively. Apparently someone had told Belmondo that if he took on the role in Breathless he’d never work again. He went on to have a career that lasted 50 years. Wonder if anybody said that to Dullin.

(Available on Netflix)

Train Dreams ⭐️⭐️⭐️

This movie is magnificently filmed. Set in Idaho, there is stunning scenery and some breathtaking shots of everything from sunsets to forest fires. It really should be seen on a big screen. Only problem is you would also have to see this story. It is somber and dour.

Train Dreams is about the life of Robert Granier. It takes place in the first half of the 20th century. Granier is a logger. He works on traveling crews cutting through forests. He also becomes a self-described “hermit in the woods.”

The name Train Dreams comes from the fact that Granier slumbers off into dreams, sometimes on trains, but at home as well. He dreams of his past (not flashbacks but scenes we’ve already seen). This is not a man who can go forward.

Death is all around this story. Some from catastrophe, some from carelessness and some outright murder. If you’re feeling like you want to spend the night depressed, slog your way through this one.

(Available on Netflix)

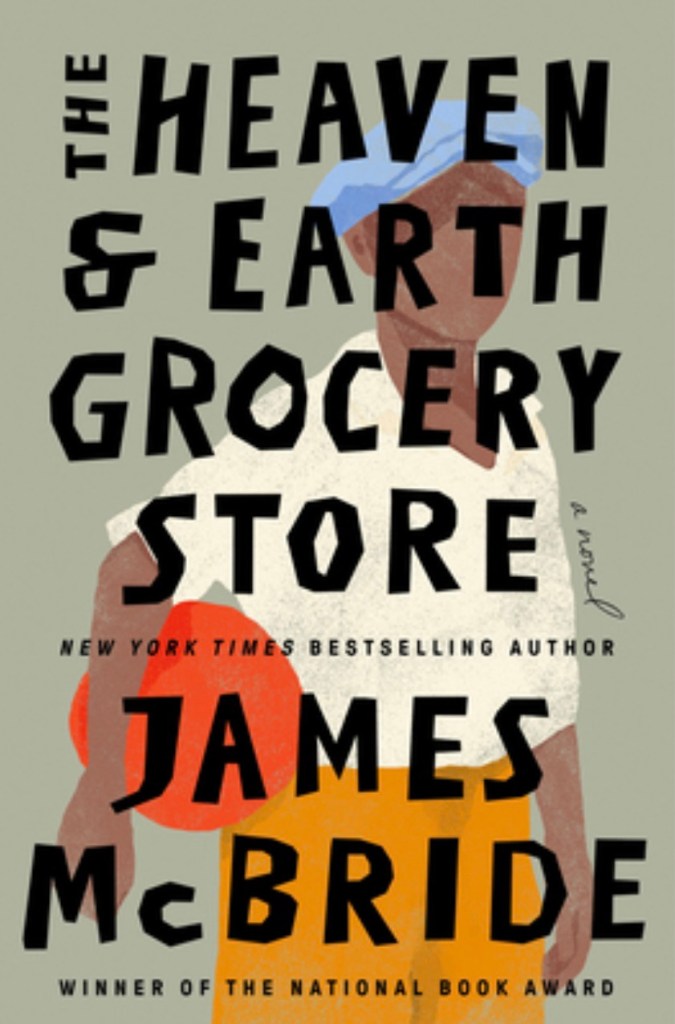

The Heaven and Earth Grocery Store is what you hoped America would become. It’s set in Pottstown, Pa., a city that was industrialized, a city where immigrants came to find jobs, a city where Blacks migrated from the south with the mistaken hope of freeing themselves from racism. The story is set in the mid-1930’s.

The general store, located in a poorer part of town called Chicken Hill, is run by a partly disabled young Jewish woman. Chona treats everyone with a smile with no regard for race, religion or ethnicity. A pretty fair percentage of Chicken Hill can remember getting food from Chona when they couldn’t afford it. The store loses money every year but her husband runs a successful theater business.

The humanity of the Heaven and Hill Grocery Store stands in stark contrast to injustice and discrimination that is rampant, much coming from the long-term residents who can’t accept the newcomers. For while the store is what you hope America is, the racism, antisemitism and vilification of immigrants is unfortunately part of what this country is now.

McBride is a brilliant storyteller. He exposes the soul of the ordinary man, the under-valued, the unnoticed. He adds a little mystery and suspense as well. In a story that’s otherwise full of love there’s also gangsters, crooks and sexual predators. This is the most human of novels.

Doc Hata is what you might call a model citizen. A retired Japanese-American small businessman who ran a medical supply store in a well-heeled New York suburb, he is respected and liked by all the townsfolk. Many remember a favor he did for them at a time of need.

But that is only part of the story. Casual relationships are his stock in trade. Serious ones have proven to be a string of failures. That includes his first love, a young Korean woman forced to become a “comfort girl” at a Japanese army encampment during World War II. He failed with the widowed neighbor who he had a short relationship with. And, most importantly, he failed with the daughter he adopted from Korea.

It is in the words of that daughter that the author explains the title of this tale. “You make a whole life out of gestures and politeness.” She didn’t mean it as a compliment. His response “And why not? Firstly, I am Japanese.”

But even his Japanese heritage is called into question as Doc Hata’s personal story unfolds and becomes more and more separated from his public persona. After one uncomfortable episode, he comments “routine triumphs over everything, as it always does with men like me.” One of the things it triumphs over is passion.

This book is meticulously written. An exceptional depth of character emerges as the tale progresses, going both forward and backward in time. The pace with which the details of Doc Hata’s life is unveiled creates a slowly building, but suspenseful read.

Joseph Madison Beck has written a moving tribute to his father Foster Campbell Beck. But the story is so much more. It’s about south Alabama and the people that live there, about a region that never stopped defining itself in terms of the Civil War. It’s a story of racism, historical, but seemingly never ending.

The Beck family for at least three generations, which includes the author’s grandfather, would be considered “progressive” on racial issues, at least by Alabama standards. The author himself is a lawyer in South Alabama like his father. The centerpiece of the story is Foster Campbell Beck’s decision to represent a black fortune teller from Detroit who is accused of raping a local white girl. It’s 1938 and it’s a decision that benefits neither his firm’s finances nor his reputation locally. And the ramifications go long past the actual case. What it does support is “my father’s lifelong passionate belief that the law was there for the poor as well as the rich, for blacks as well as whites.”

Atticus Finch is the lawyer in Harper Lee’s 1950’s novel “To Kill a Mockingbird.” In that story Finch also represents a black man accused of raping a white woman in south Alabama. James Madison Beck hints that some have suggested his father’s case inspired the novel, although Lee has denied any connection. Maybe from Beck’s viewpoint this best selling novel just dramatizes the courage and conviction that his own father showed.

It’s no easy task to write about a father of whom you are enormously proud without being overly sentimental or preachy. Beck has done that. His is a story told in a straightforward manner based on meticulously researched facts. There’s plenty of drama, especially in his account of the trial of the accused man, Charles White. And there’s a bit of family drama as well. All in all, a great story, skillfully told.

Thi Bui was one of three children along with her father and eight-month pregnant mother who fled Vietnam by boat after the fall of Saigon in 1975. Thi tells the story of her family but also the history of Vietnam. It’s about her parents and her parents’ parents through the years of Japanese and French occupation and American intervention.

But the best part of the book is in the story of this family as ‘boat people.’ How they managed to find a boat to escape on, their experience at a refugee camp in Malaysia where Thi’s mother gave birth, and then their resettlement in the U.S., first in Indiana and then in California. At a time when U.S. politicians are trying to win votes by demonizing refugees and immigrants this is a timely tale. A different time and place but a reminder of what these people go through and why.

There are also stories about the author and her more recent life in America. The opening chapter is about her experience with childbirth and she closes the book with a bit about how hard parenting can be. It’s these experiences that put some perspective on her thoughts about her parents, some appreciation of what these imperfect parents who she is not always in synch with went through.

This is the first time I’ve read a full-length graphic novel. It took me a little while to get used to looking at the drawings and not just reading words. The pictures tell a story too. I certainly became engaged and ended up appreciating the format. Just might pick up another one someday.

All about the in-laws. Nate and Keru (rhymes with Peru) are a Manhattan couple who rent a Cape Cod summer house and reserve one week each for the two sets of in-laws, separately of course. The two visits are equally awkward and in each case it’s not clear who’s more uncomfortable, the offspring or his/her partner. At one point Keru stations herself on the toilet while Nate showers to avoid being alone with his parents.

Keru is second-generation Chinese. Nate is from a poor white Midwestern family. No amount of surface civility can mend the chasm that seems to create.

The story then skips ahead five tears to another seasonal rental, this one is upstate New York. No in-laws this time, just curiously intrusive neighbors and Nate’s ne’er do well brother. It’s just as awkward and the awkwardness seems to have spread into Nate and Keru’s relationship.

Life just seems to happen in this novel and in the end one suspects it will continue to happen. There’s no drama, tragedy, excitement or any obvious evidence of love for that matter.

That is not to say it’s boring. This is a lively, fast read that’s often worth at least a chuckle. Few of us married folks could claim we couldn’t relate to something about these in-law interactions.

Newark Museum of Art

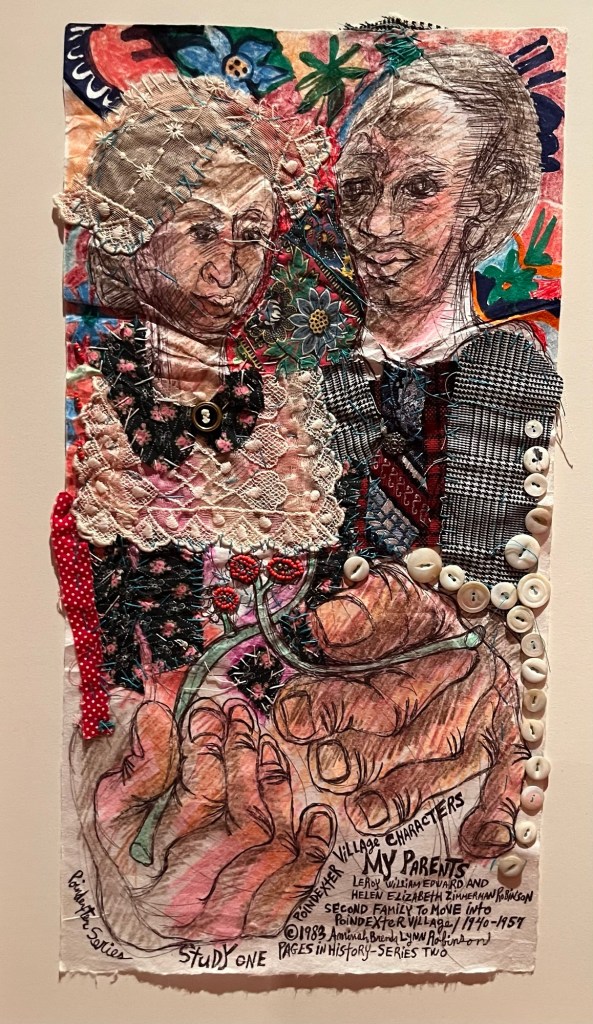

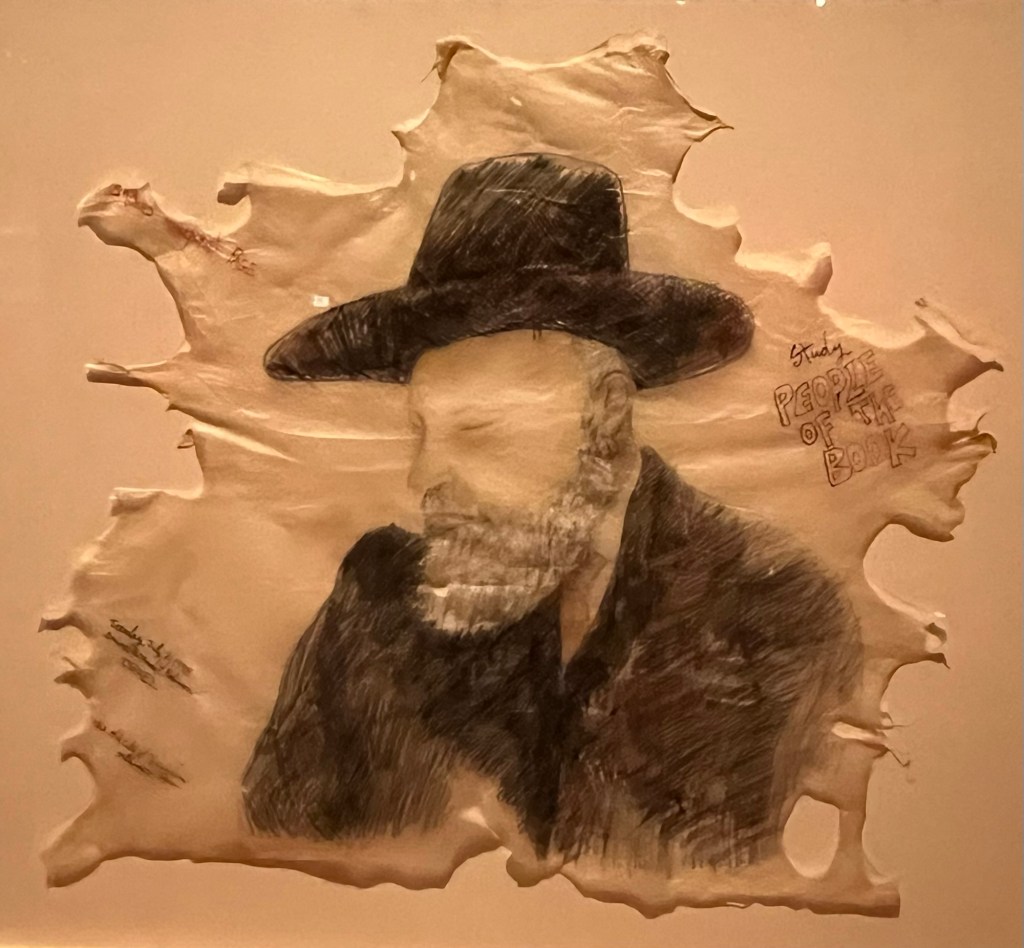

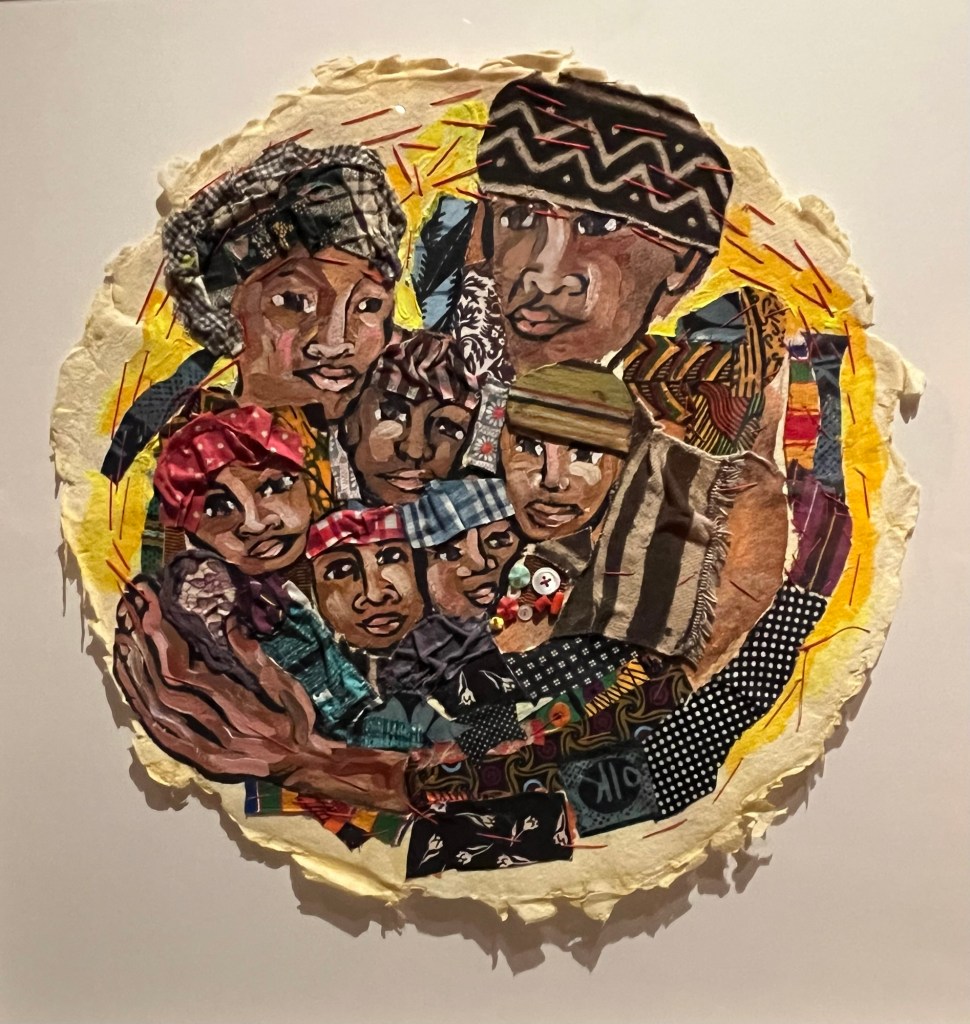

Brenda Lynn Robinson was born in 1940 in Columbus, Ohio, the daughter of two artist parents. She would later adopt the name Aminah after it was given to her by an Egyptian cleric while she was traveling in Africa. Robinson’s art tells her story — what’s important to her — her family, her home, her experiences. The works on display in this exhibit are on loan from the Columbus Museum of Art where she bequeathed her art when she died in 2015.